The stock market is reaching new highs. People are talking about inflation again. Goldman Sachs has never had it so good. Corporate mergers and takeovers are happening. Everyone is looking to US president Donald Trump and his policies as the engine of world economic growth. Despite the volatility he personally injects, things seem to be going well.

Though you’d never know it listening to Trump, unemployment is at a historic low, as is crime, bankruptcies and debt delinquencies. Four US stock markets, the Nasdaq Composite, the Dow Jones Industrial Average, the S&P 500 and the Russell 2000 of small capitalisation stocks each closed at a record level for four consecutive days last week. Last time that happened was in 1995.

The bet is that Trump - a lying, racist, misogynist who has never held a public policy job before - will deliver on his campaign promises to cut taxes for everyone, spend borrowed money on infrastructure, slash regulations across the board and spur economic growth. Despite his own lack of credibility in delivering any of these barely sketched-out policies, market participants are gambling that the smart people behind Trump can craft a policy package to get through the Republican Congress in time for the mid-term elections, which may well see the Congress swing Democratic, and thus block Trump as it blocked former president Barack Obama. So right now, it’s risk-on for equities and, crudely, stock markets go boom. If Trump’s team fulfils his campaign promises, the result will be large windfalls for the corporate sector, and the corporate classes in the US. It is telling that Goldman Sachs has never traded at higher levels, a reflection that the swamp-draining is not going well.

Trump’s campaign on tax reform would help the rich more than most. The highest income taxpayers in the US, those with incomes over $3.7 million per year would experience an average tax cut of nearly $1.1 million, over 14 per cent of after-tax income.

Households in the middle of the income distribution would receive an average tax cut of $1,010, or 1.8 per cent of after-tax income, while the poorest fifth of households would see their taxes go down an average of $110, only 0.8 per cent of their after-tax income.

In Donald Trump’s America, after his policies are applied, the rich take home $1,100,000. The poor take home $110.To put the difference in another scale, 110 seconds is nearly two minutes. 1.1 million seconds is nearly 13 days.

Trump vs Ireland Inc

Hand in glove with his pro-business, pro-wealthy tax policies, Trump has promised a series of tax changes to force US consumers to buy American and US producers to hire American. A combination of a high import tax and an export-tax exemption has been mooted. This is bonkers, because the ‘weight’ of the tax will fall on you depending only on whether your business happens to be an importer or an exporter.

Worse: in a world of global supply chains, export-oriented companies that need to import intermediate products from other countries will get whacked. It also means the people who get taxed will pass their increased costs directly onto consumers of their products, if they have enough market power to do so.

The result? Higher prices for everyone, and a good deal more domestic inflation, which hurts the old, the poor and everyone else on fixed incomes. The retailer Wal-Mart is the largest importer in the US and has lobbied against the import tax, alleging it will drive up prices and cost people their jobs. The economics textbooks are right: taxes are distortionary. The ‘border adjustment tax’ will generate hundreds of billions per year in revenues for the government, which it can use to offset the decline in revenue from cutting income taxes.

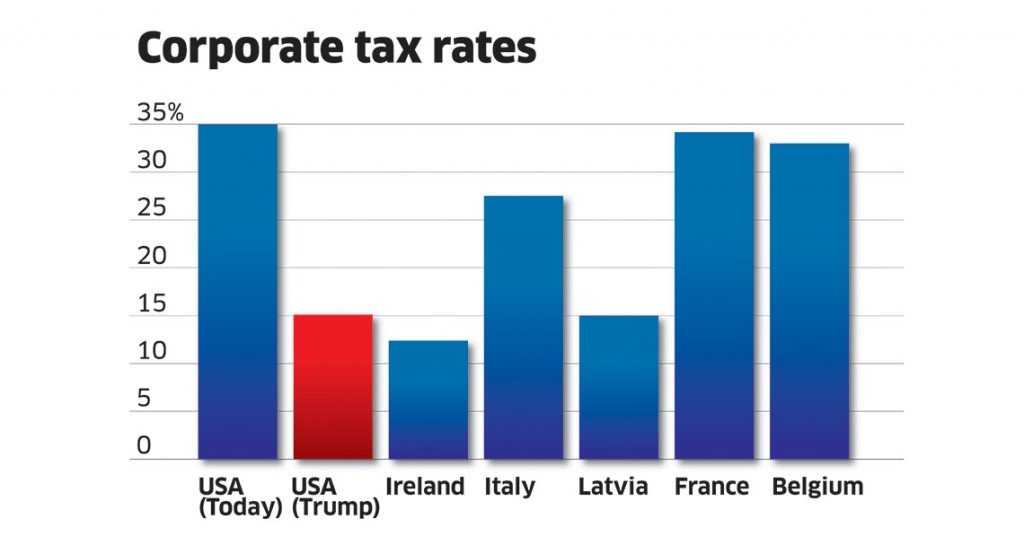

Ireland’s exports to the US were worth €26 billion last year. Import tariffs on these exports will hammer us. The changes to corporation tax, shown in the graph (above), may challenge future investment in the Irish market. I don’t think we’ll see the big pharma companies walking away, but incremental investment may fall.

One reason incremental investment may fall is candidate Trump promised a one-time repatriation tax of 10 per cent of corporate profits held overseas. Ireland is a key recipient of these overseas corporate profits. If president Trump delivers, we could see large amounts of money heading back to the US, especially if Trump can turn the country against the companies that don’t bring their profits home.

Ireland is one of the most open economies on earth. We funnel vast sums of money around the globe, our highly-educated workers are in demand all over the world. Our foreign business-friendly industrial policy has been the envy of the world for 60 years.

Ireland is a tiny economy, responsible for less than 0.2 per cent of the world’s economic output in 2014. Yet in the same year, Ireland ranked first in the world for the flow of new foreign direct investment into any country. Much of this money comes from the US, and is from the financial services sector. For both quality and value of FDI, Ireland is the Lionel Messi of getting other people’s money. Trump might end that.

The IDA, once an instrument of protectionism, is a world-leader in what it does. The IDA has a singular purpose, a vision for what it is there to achieve, excellent people working there, and a policy environment designed by generations of politicians and civil servants to help them succeed. The results speak for themselves: last week, Microsoft announced 600 new jobs, and Indeed.com, a job site, announced 500 new jobs.

But last week’s announcement of 500 jobs going at HP in Kildare shows how volatile this sector can be, and how dependent we are on multinationals to supply much of the job growth we see, especially for high-end jobs.

Trump has the power, and the mandate, to achieve sweeping changes to the economic system of the United States and, by extension, the world. Tiny states like Ireland must prepare to adjust or find themselves poorer as a result

Enterprise Ireland, by contrast, has a remit to bring domestic firms up to a level where they can compete internationally, and must do its job in a completely different policy environment.

The tax-benefit system in Ireland actively discourages small businesses getting set up. The downsides for business failure are very large. Enterprise Ireland’s budget has been cut substantially since 2007, losing many of its staff and seeing a change in its core remit, including helping to contain the Brexit fallout.

It’s worth comparing the press releases of the IDA and Enterprise Ireland. The IDA just announces when new jobs get created. Enterprise Ireland has a varied output of accelerators, prizes, press conferences and Brexit meetings.

These agencies don’t play the same game, and they aren’t supported in the same way. Donald Trump being in the White House means we need to pivot away from basing our development strategy on attracting foreign businesses towards supporting Irish businesses in competing with the rest of the world. Consider this: if policy makers treated Irish firms the same way multinational firms are treated, what would the outcome be?

Trump’s zero achievements

Trump’s presidency has been a great cacophony and an injection of volatility the world didn’t need. He has achieved nothing so far.

By this stage in his presidency, Obama had passed the stimulus bill which saved the US from another Great Depression, passed the fair pay act, which made it illegal to discriminate against people based on their gender or religion, and expanded children’s healthcare. Trump has repealed some executive orders of Obama’s, and botched a ban on people from seven largely Muslim countries entering the US while allowing Christians and Jews from those countries to enter and repealed orders closing coal mines. The signal is far, far weaker than the noise.

Trump has the power, and the mandate, to achieve sweeping changes to the economic system of the United States and, by extension, the world. Tiny states like Ireland must prepare to adjust or find themselves poorer as a result. We have to rely on the quality of our strategic thinking, and one thing Trump might mean is the end of US-led FDI.

Tiny states like Ireland can’t avoid being hit if, and when, the Trump policies do begin to come into effect. For example, the Associated Press reported last week the Trump administration is considering mobilising the National Guard to detain up to 100,000 illegal immigrants. Some of those illegal immigrants are surely Irish, and may well force us to consider our diplomatic approach to the US.

Ireland is caught between Brexit to the east and Trump to the west.

Surviving Trump alone means supporting Irish firms in the same way we support foreign firms, and perhaps more so. It is time to take an all-island approach to the creation of indigenous firms.